Minimal Rehab, High ROI, Another Manufactured Housing Deal Completed

Purchased a cheap fixer of a mobile home that no one else wanted and turned it into a great note.

Apologies for falling off the map for a few months. Been busy pivoting to land development but I do have a few deals that I want to post in the next coming weeks that I’ve completed.

Acquisition

I came across this deal from a wholesaler. Originally was asking 75k. I hit them at 35k and struck a deal at 40k in the end. No one else was touching this deal from the wholesaler’s network of buyers and that’s why I was able to get it at a steep discount.

This one needed a complete renovation, probably needed to be demolished in the end but I made a deal out of it just cleaning it up. My very first walkthrough is below comepltely unedited. The backyard was also a mess, but it’s not shown in the video.

Rehab

Never factored in doing a complete renovation, this was essentially going to be a wholetail scenario. Lots of trash out, yard clean up, tree cutting and tire removal. There were a ton of tires in the back yard and you can’t just throw those into a dumpster, have to take them to a recycling facility. Here is a video walkthrough, half way through the rehab.

The clean out took about 30 days, and cost about $16k.

Resale

Looking at comparables, a rehabbed mobile home could fetch the 160k mark. Due to the fact I was selling this as-is, as a fixer, I went with 110k as the asking price. Before I even put it on the MLS, I threw it on craigslist and facebook market place.

Got quite a bit of response in a couple days. There were two buyers extremely interested that walked it within days of our post. Within a week we were under contract with a couple. They were looking for a fixer and needed me to carry the paper, which I was glad to do.

We agreed to a price of $98k with 35k down, and a note of 58k for 12.5 years at 9.974% interest. Buyer to pay closing costs, their agent (came in after the fact) and survey. Closed within 2 weeks of the executed contract.

Final Numbers and ROI

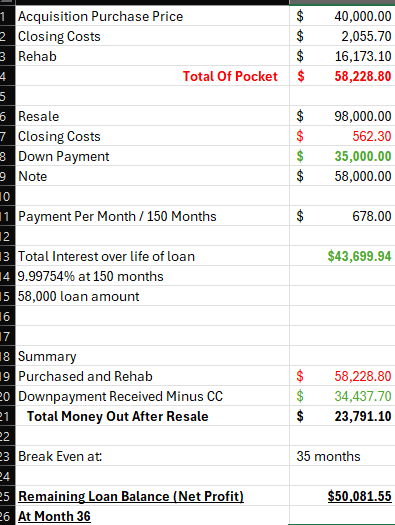

Forgive my excel breakout but there was a number of ways to analyze this ROI. My total out of pocket for the project, straight cash out of my account was $58,228.80. This includes the purchase, closing costs of the acquisition, utilities, insurance, rehab, etc.

On the resale, I received back $34,437.70 which was the downpayment of $35,000 minus some closing costs. Not a complete 1-1 from what’s shown on the closing statement, as there were other costs outside of closing.

After selling the property, and creating the note I was still out $23,791.10. The note pays $678 a month which puts my break even month right at 35 months. At the 36 month mark, if I look at the amorization schedule, my net profit is just shy of $50,000.

Netting 50k on a out of pocket of almost 24k at 12.5 years, what kind of return does that really break out to? A way I look at is it, what if I sold my note at a discount of what my out of pocket is and calculate its return?

33.66% ROI, first lien position, and passive monthly income. Seems like a decent deal in the end. I’ve got a few more note deals coming soon.